Guía paso a paso

¡Encuentra todos los procedimientos completamente explicados!

Siéntete siempre apoyado, incluso cuando no estás en contacto con nosotros.

Temas relacionados

Ver másDocuments

Customer area

How to nullify a document?

According to Hacienda regulations, it’s not possible to place documents in a draft state or change them once they have been finalised. However, they can be nullified.

Since the documents haven´t been delivered to the customers or communicated to the Hacienda, manually or electronically, you can nullify them regardless of the issuing order.

For this reason, it is important to understand that you can nullify any document. Since it was the last one to be issued and cancelled, the documents do not disappear from the account.

Documents you can put in the annulled state:

Sales documents

- Invoice;

- Simplified invoice;

- Pro forma invoice.

Settlements documents

- Receipts;

- Credit notes.

Transports documents

- Bills of lading.

Other documents

- Budgets.

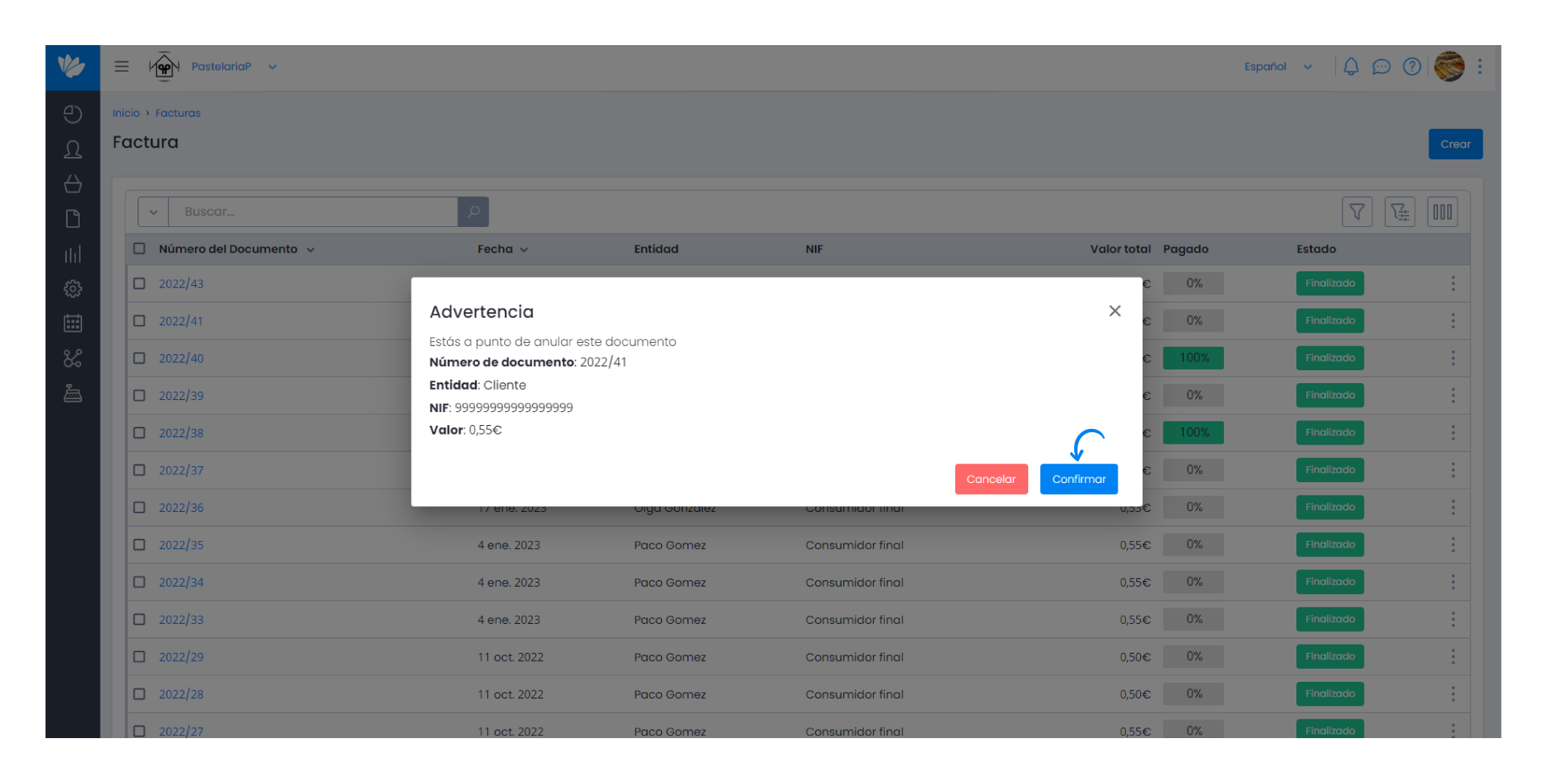

By following this process, the user is registered and associated as the person responsible for the operation towards the competent authorities. This operation is irreversible, carefully confirm it before proceeding.

Follow these steps:

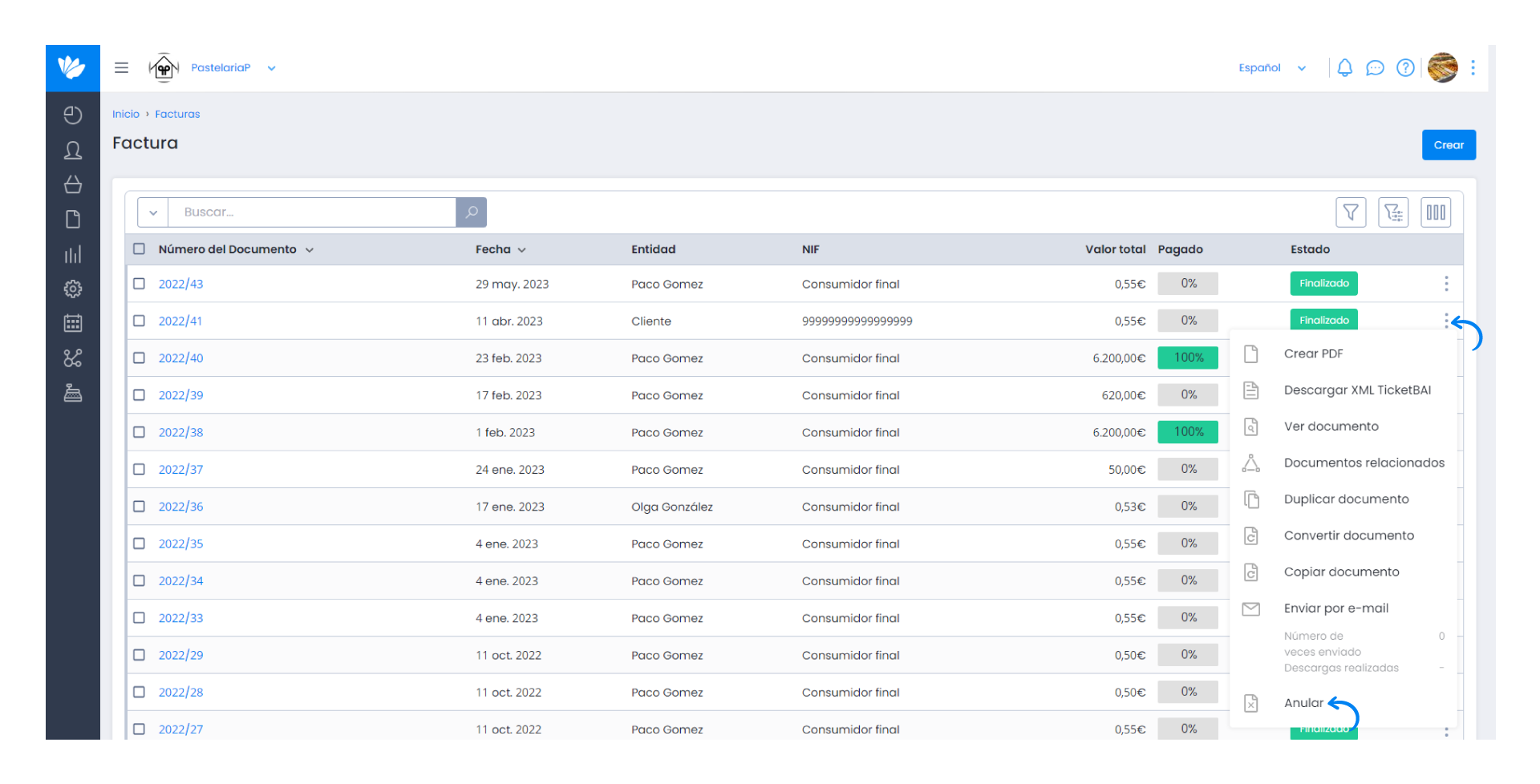

1. In any list of documents, on the 3 dots select Nullify.

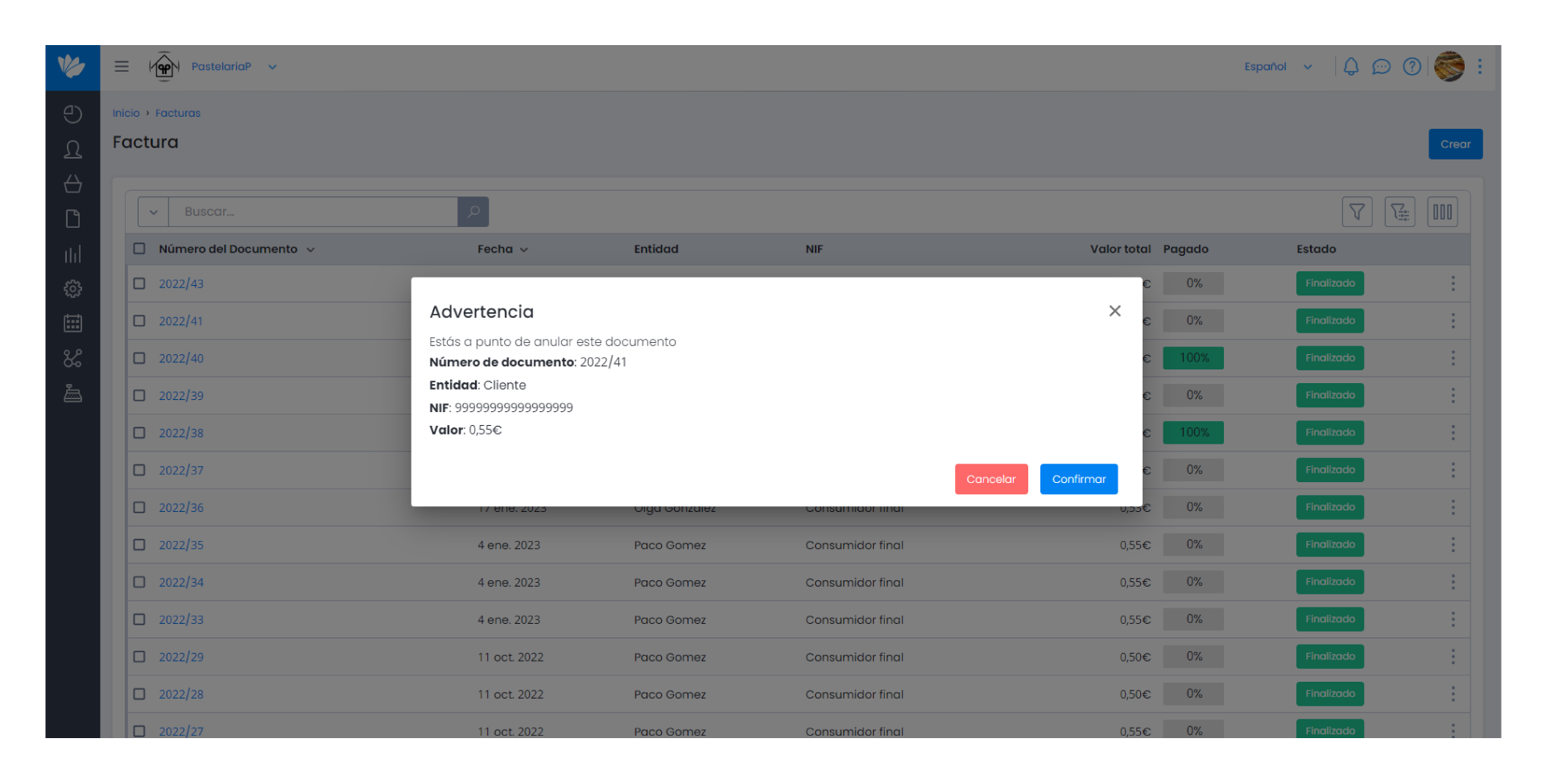

2. Then, a Warning appears. This warning shows the document number, the entity, the VAT number and the respective value.

3. To confirm the annulment, click Confirm.

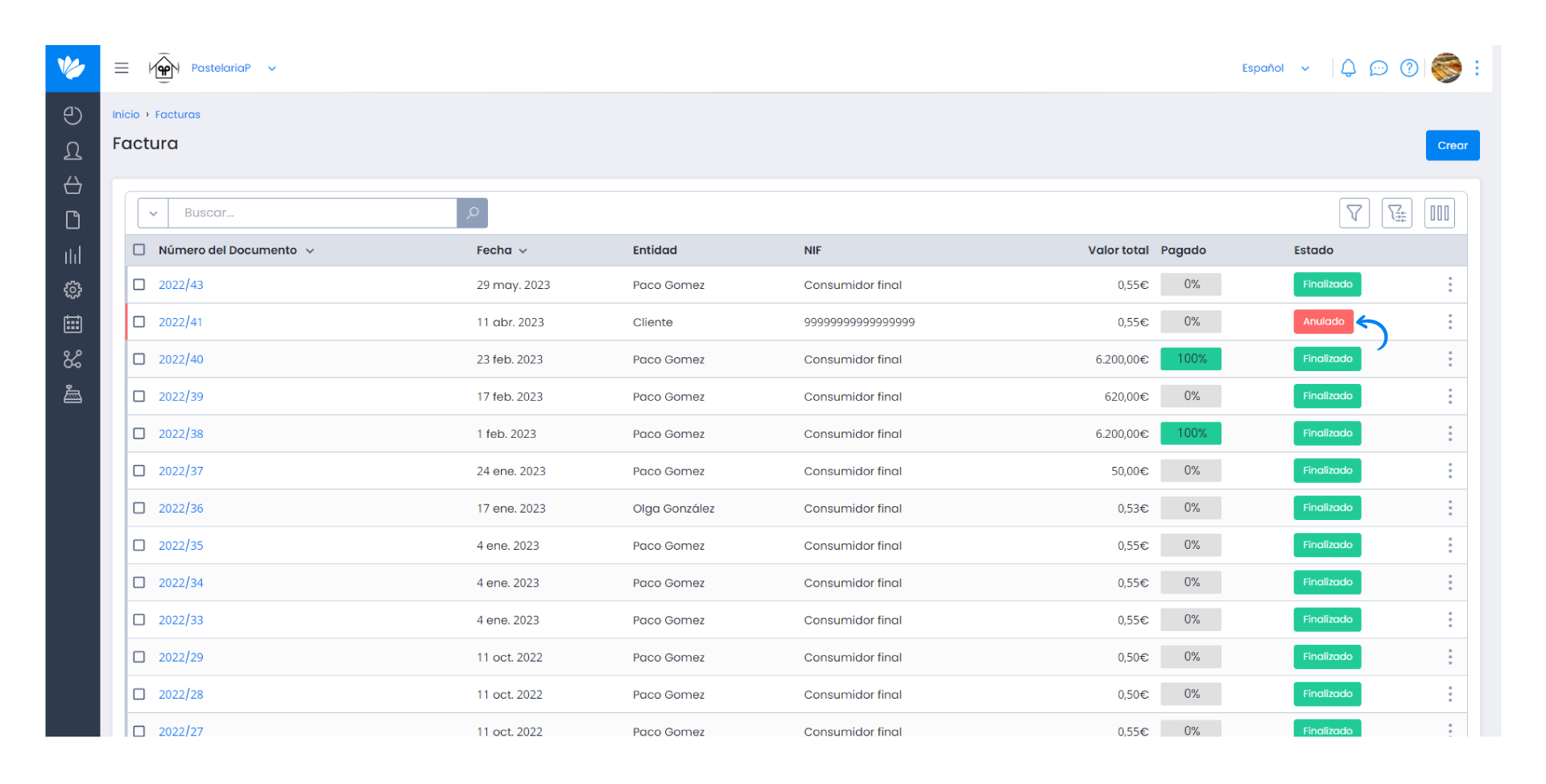

4. The document was successfully nullified. It’s displayed in the document list in a different colour.

Note:

Whenever you decide to nullify a document, you must first nullify the last document which it originated from. For example, if you issue a budget with the respective invoice and receipt, you must cancel the receipt and the invoice and, finally, the budget.