Guía paso a paso

¡Encuentra todos los procedimientos completamente explicados!

Siéntete siempre apoyado, incluso cuando no estás en contacto con nosotros.

How to apply VAT exemption to your products?

Temas relacionados

Ver másDocuments

Customer area

How to apply VAT exemption to your products?

There are activities that are exempt from VAT and must meet certain requirements. Applying exemptions in Moloni is very simple.

VAT exemptions can be applied in two ways:

- By selecting this option when creating a product;

- By choosing this option when creating a document.

When creating a product

Follow these steps:

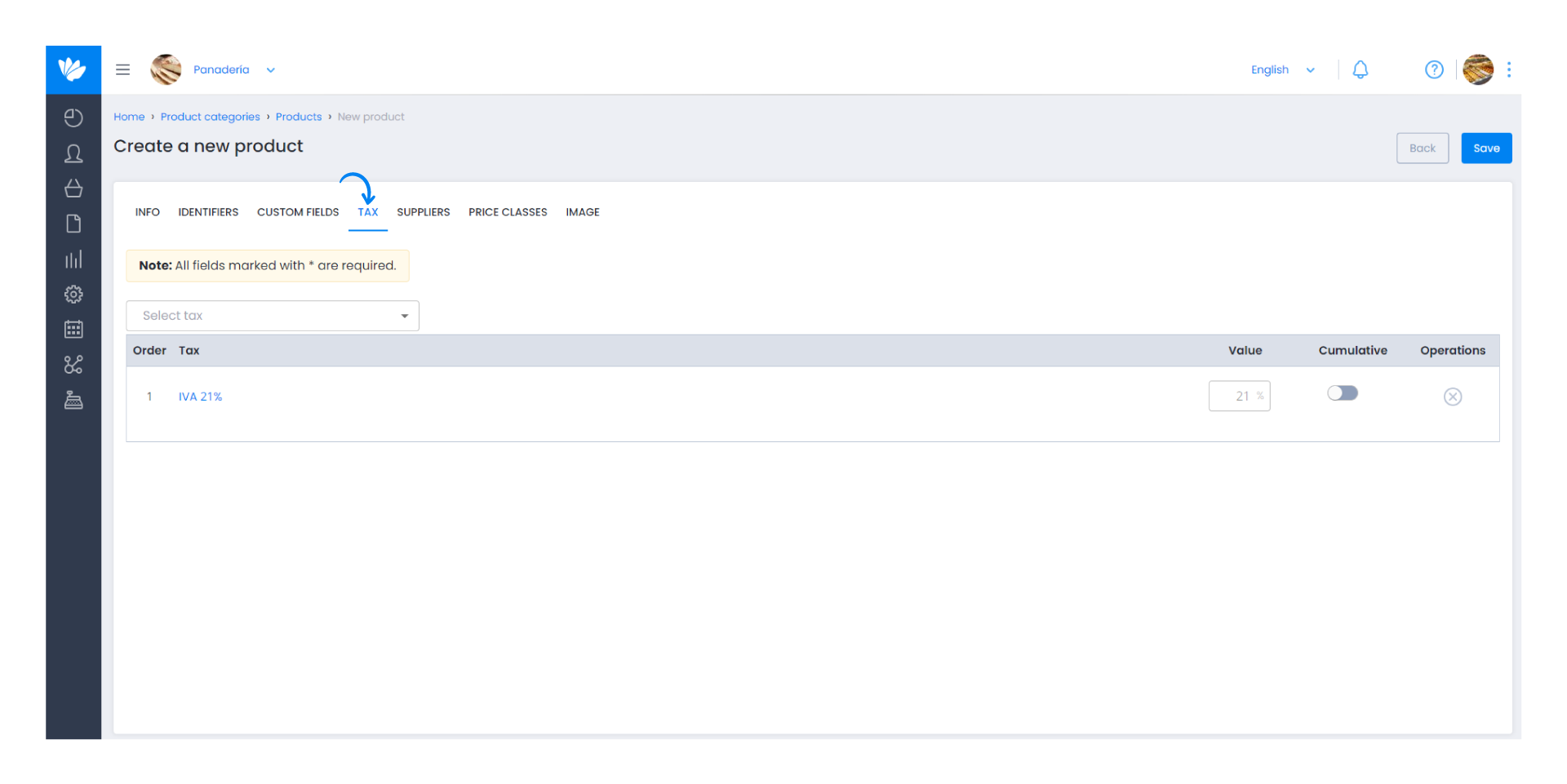

1. While creating a product, click on the Tax tab.

Check this FAQ to learn how to create a product or service.

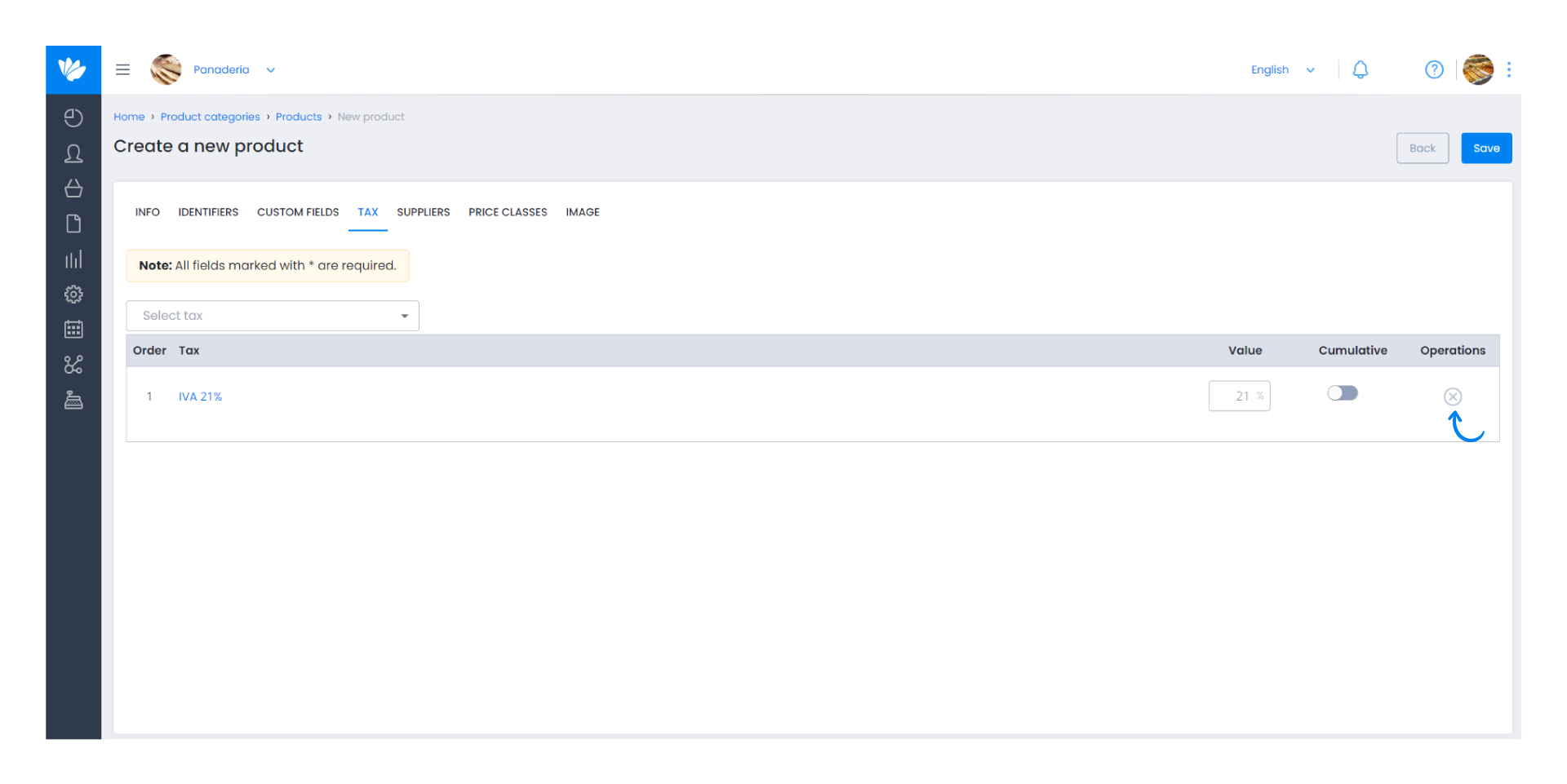

2. In Moloni, the default tax associated with products is 21% VAT. To apply an exemption to the product, you should remove the tax by clicking the (x) button.

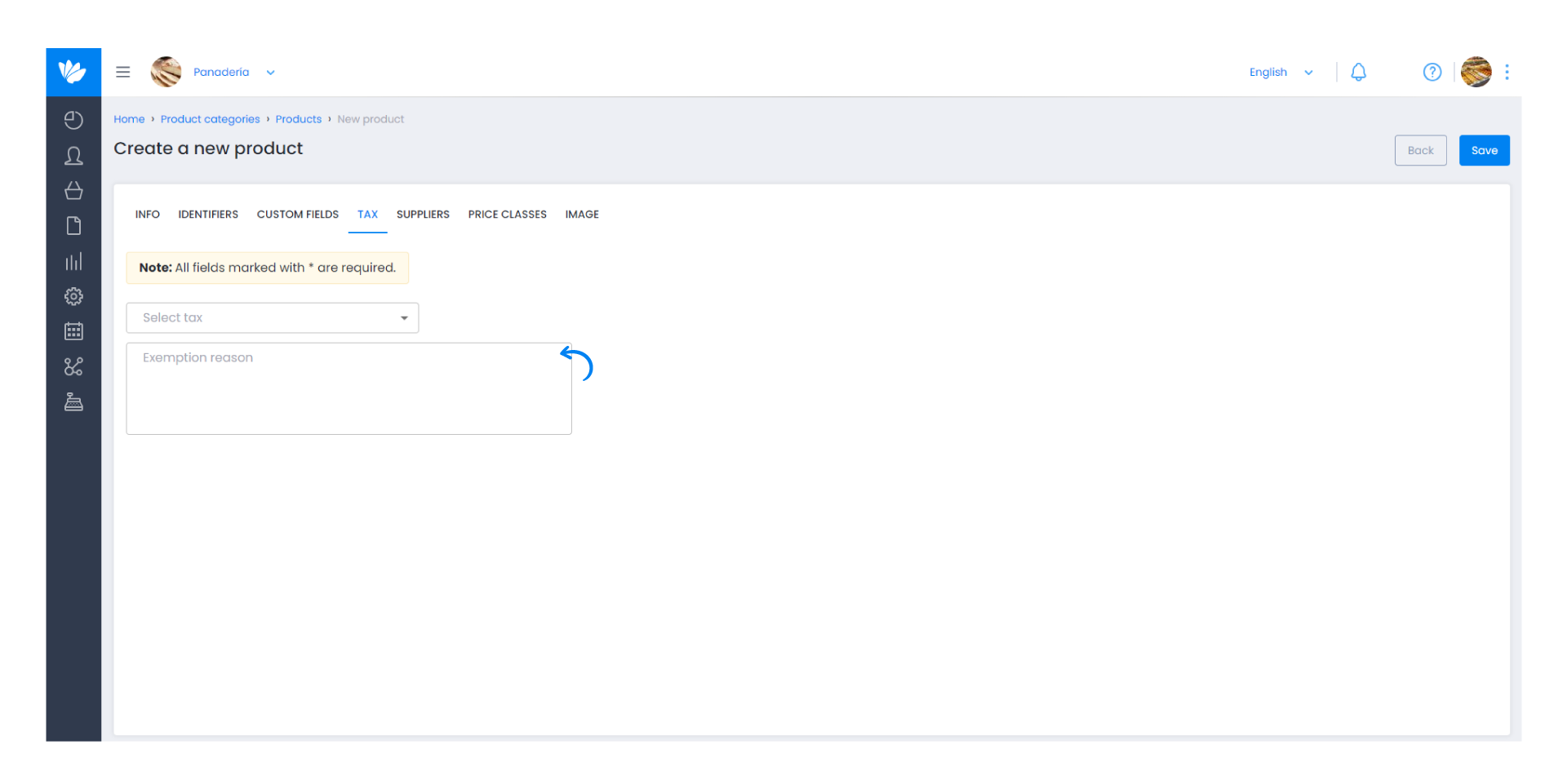

3. Finally, after removing the tax, enter the Exemption reason.

Save the changes, and the product with exemption is now ready to be used.

When creating a document

Follow these steps:

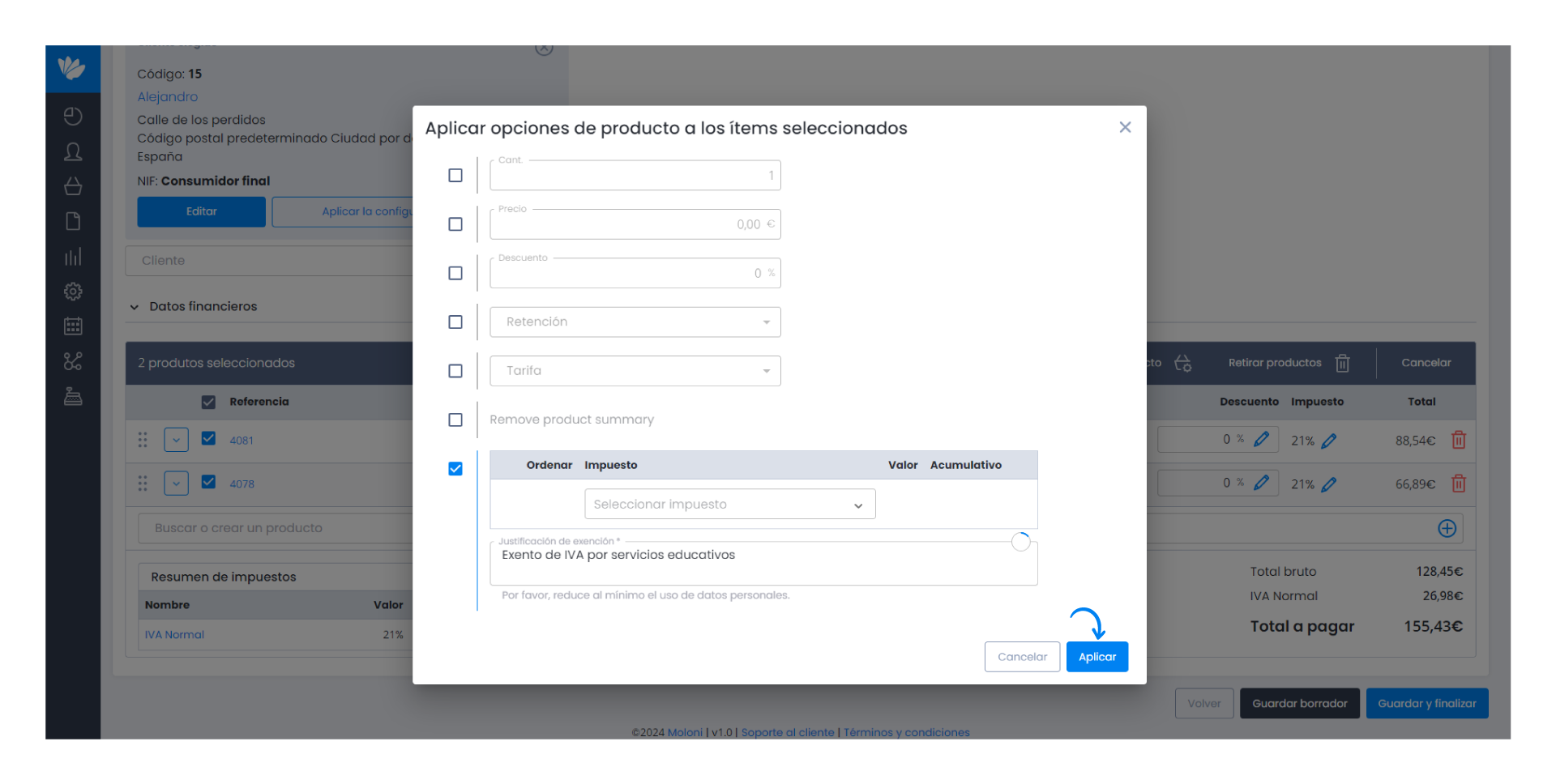

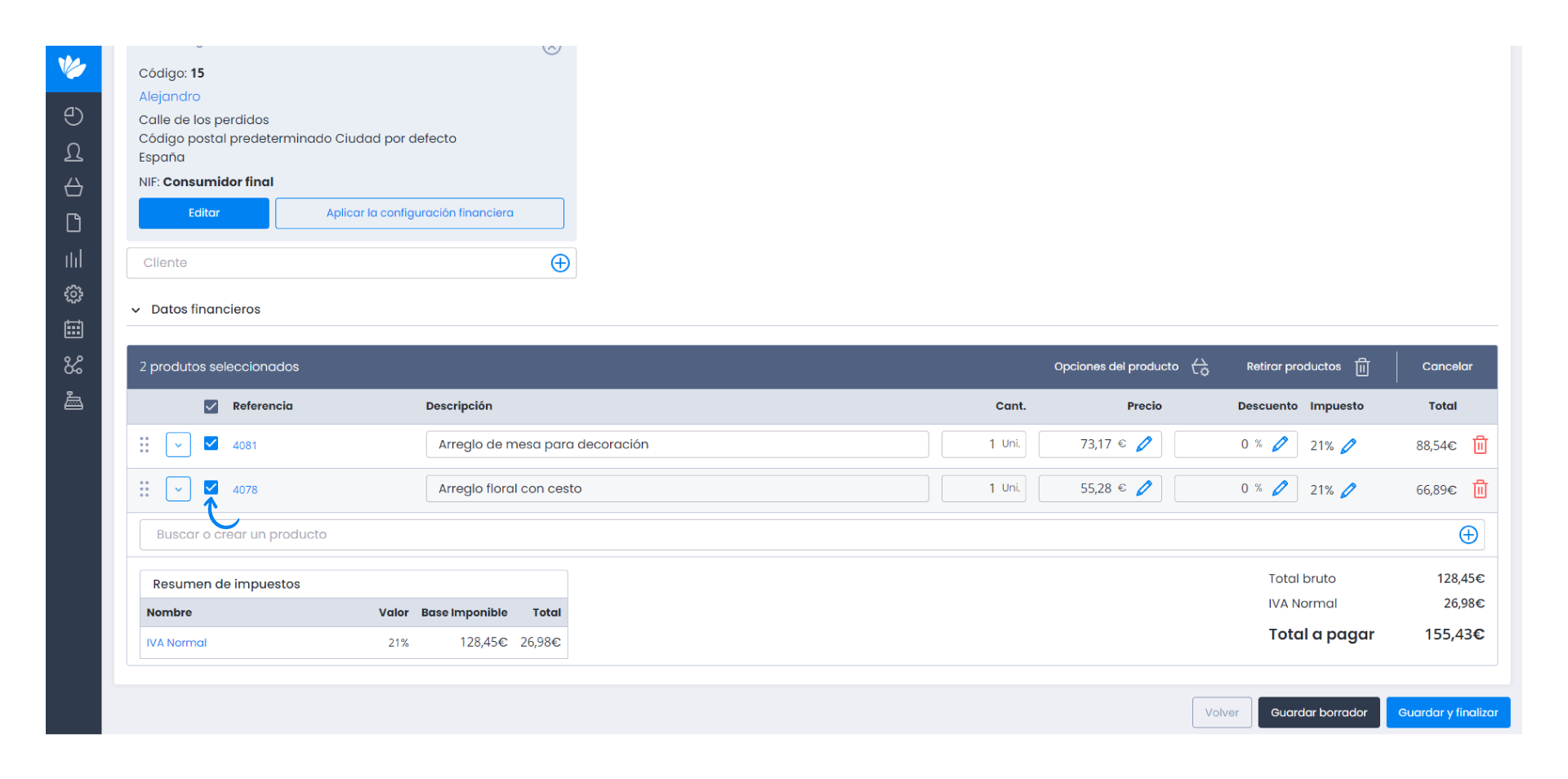

1. Add products and/or services. Select the products for which you want to apply VAT exemption.

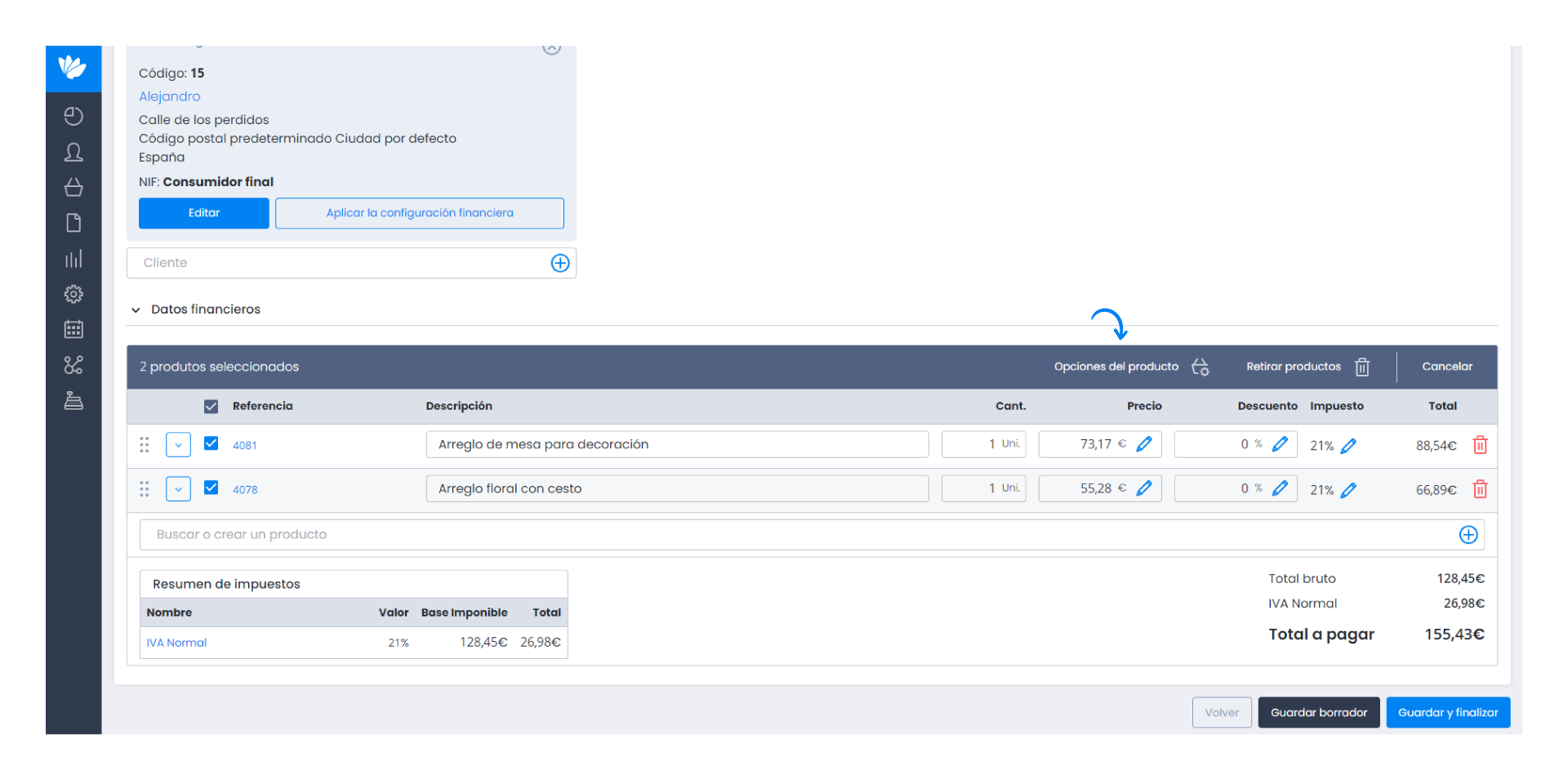

2. Click on Product options.

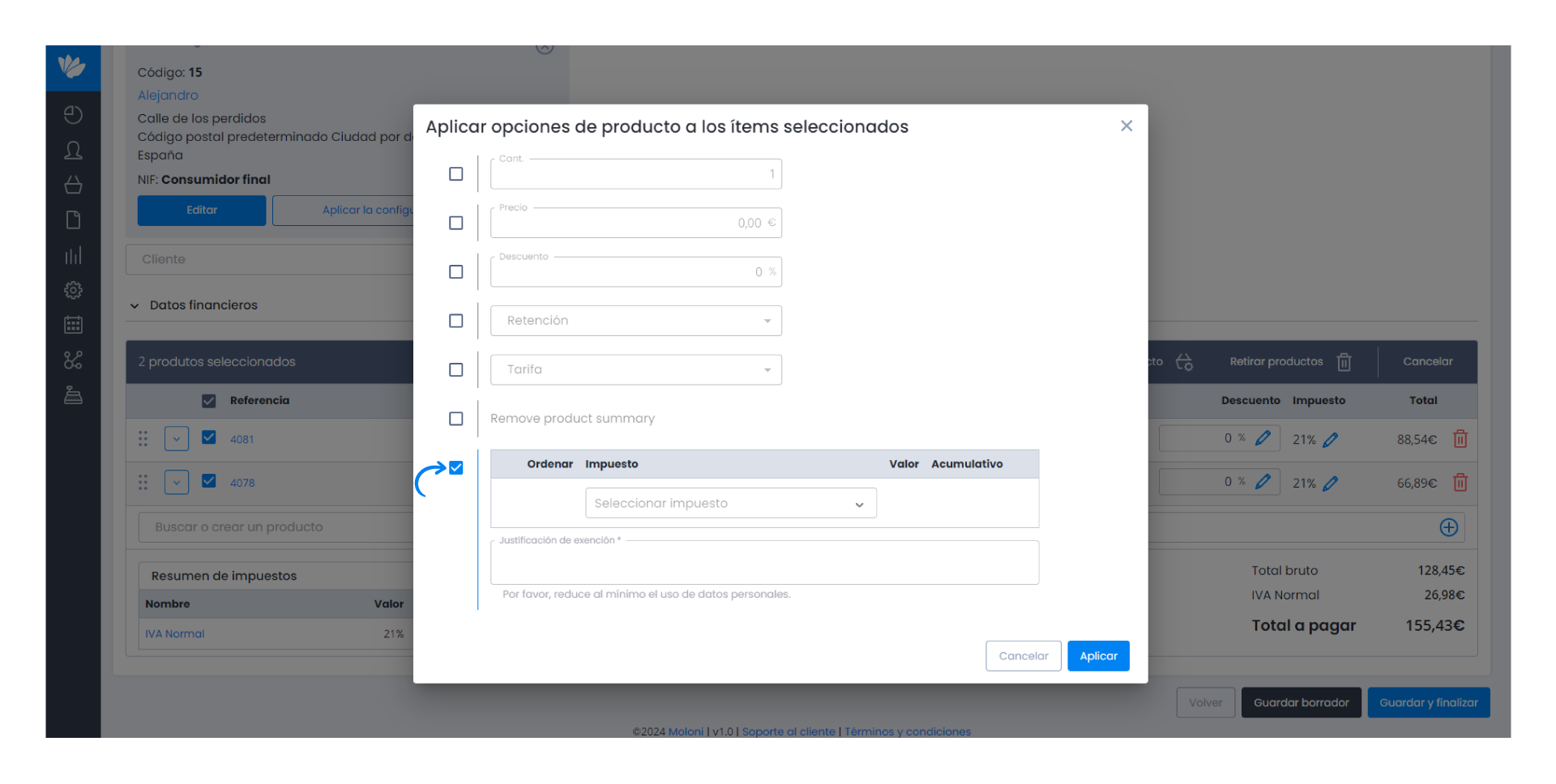

3. Check the taxes box.

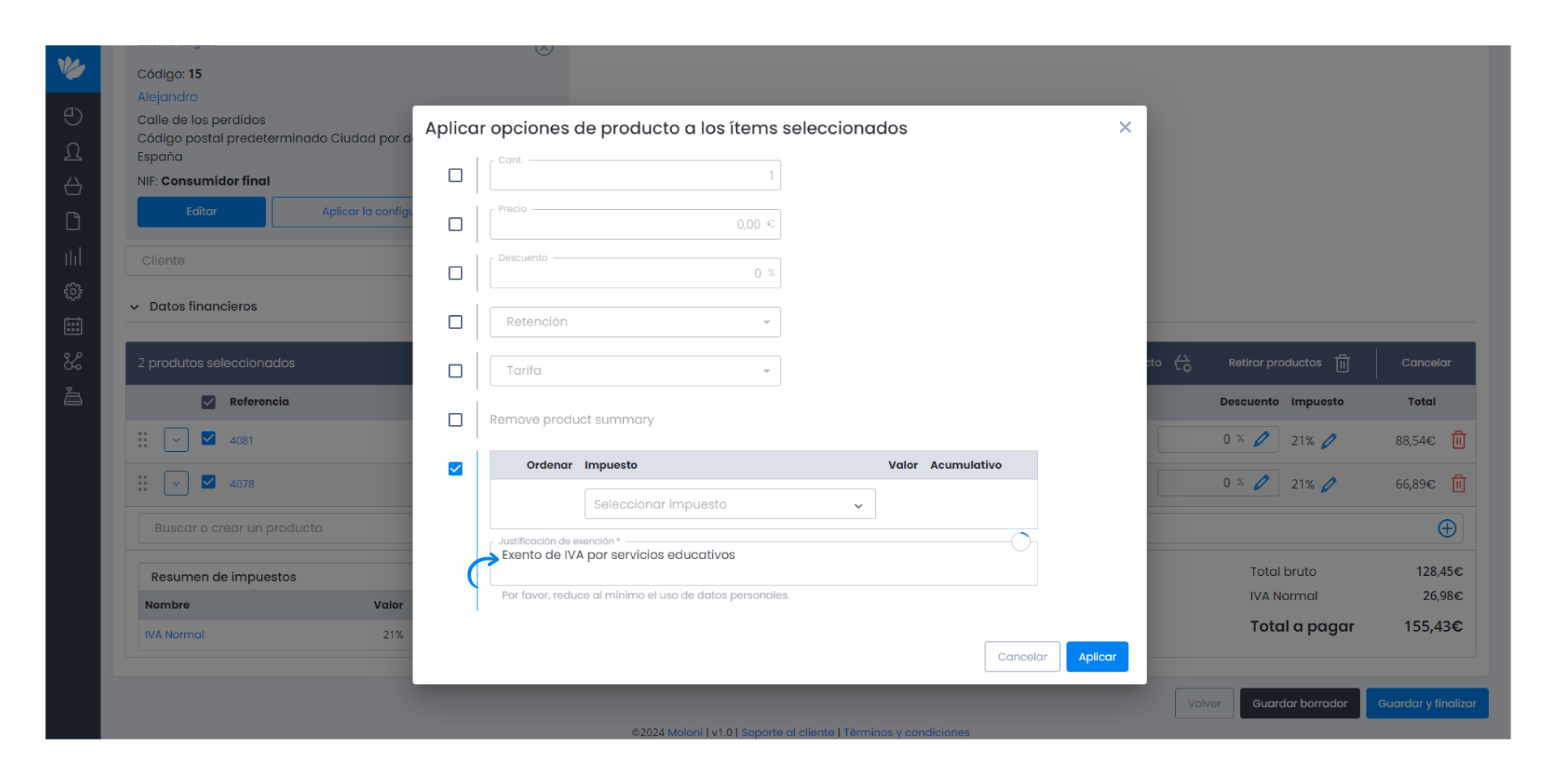

4. Enter the Exemption reason.

5. Finally, click on Apply.