Guía paso a paso

¡Encuentra todos los procedimientos completamente explicados!

Siéntete siempre apoyado, incluso cuando no estás en contacto con nosotros.

InicioSoportePreguntas frecuentes Customer areaConsults - Taxes

Discrepancy of values between the tax map and the sales extract

Temas relacionados

Consults - Taxes

Customer area

Discrepancy of values between the tax map and the sales extract

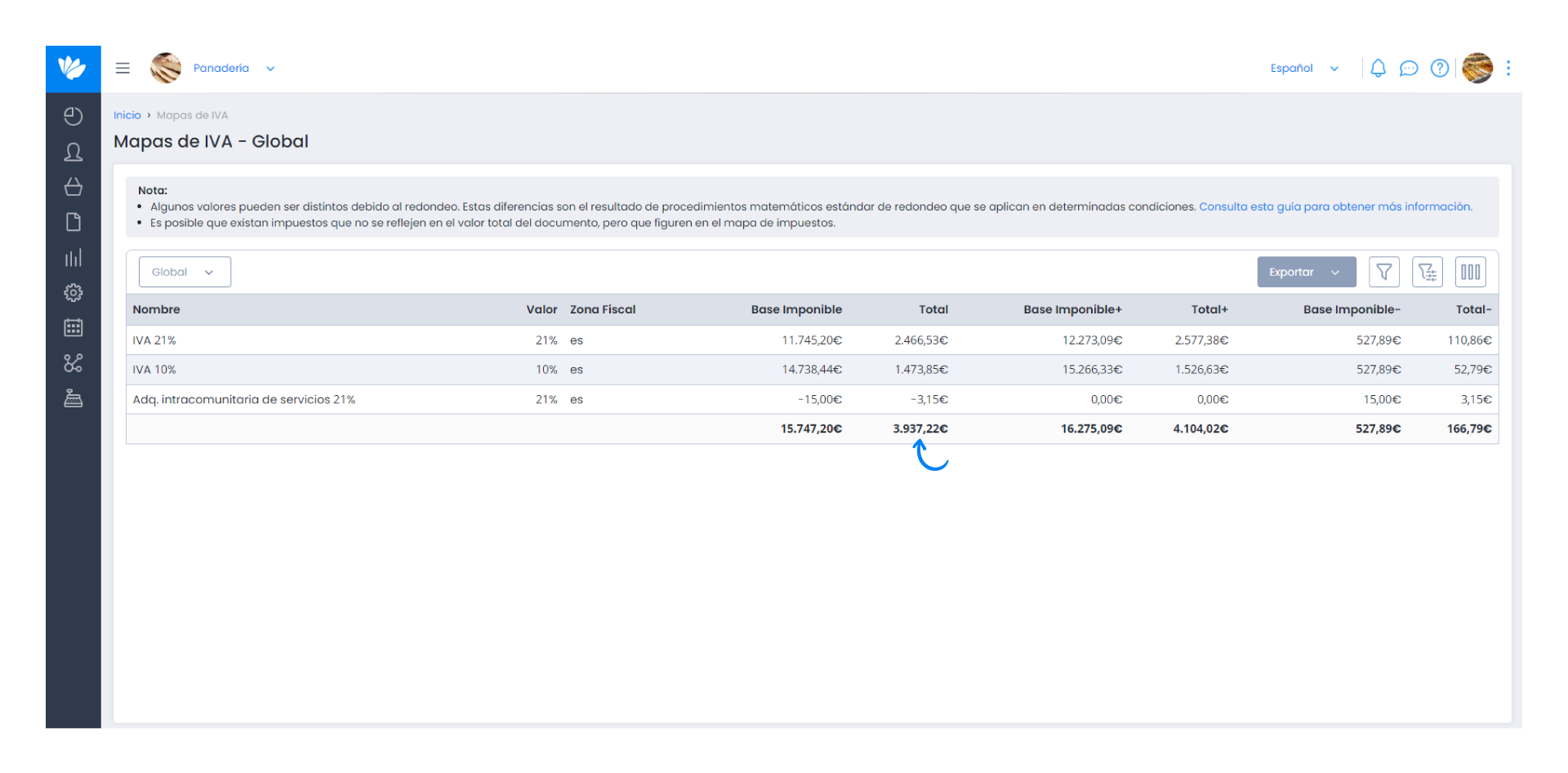

The values presented in the reports may differ due to the rounding method used. These differences result from standard mathematical rounding procedures applied under certain conditions.

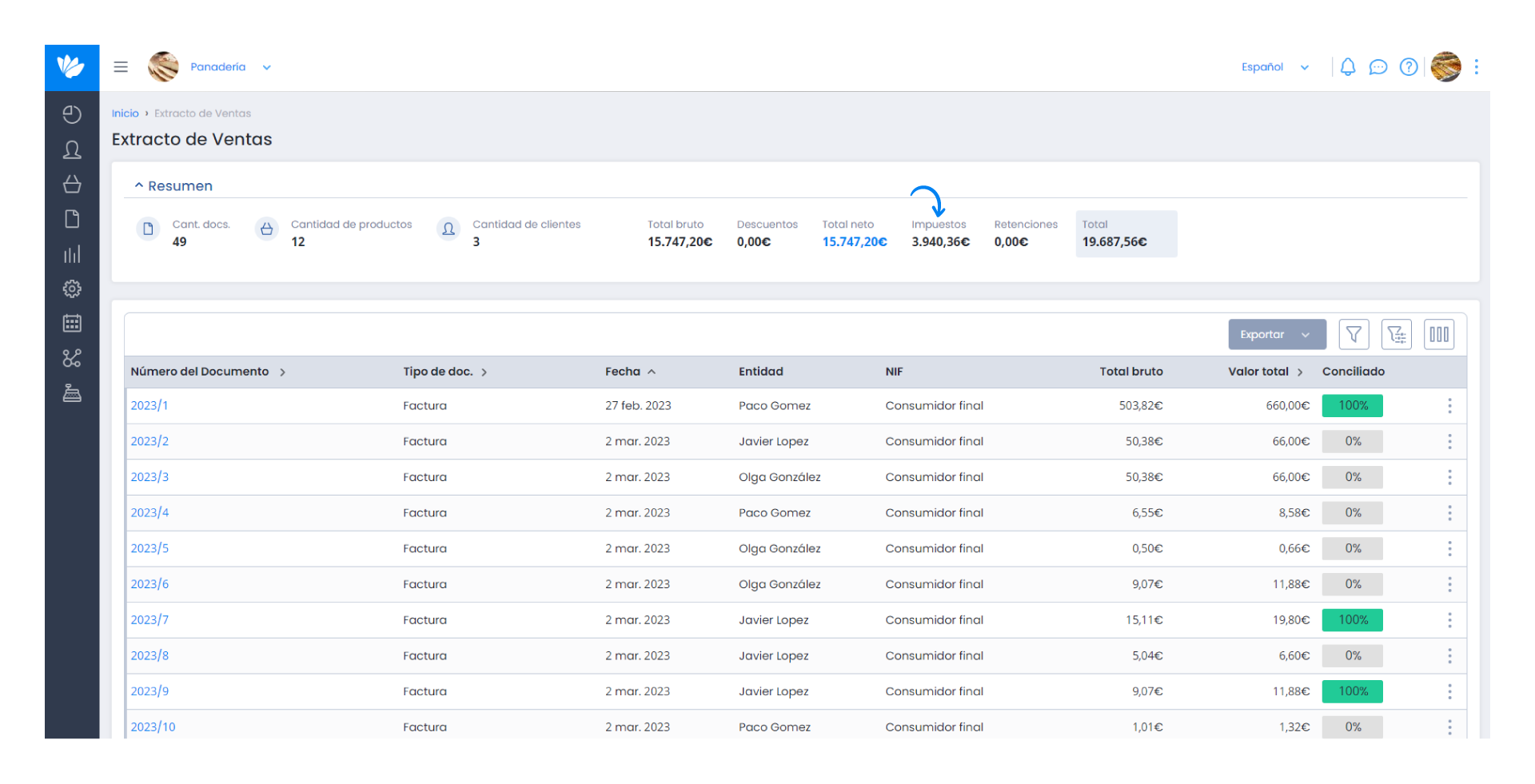

When consulting a tax map, the values presented are calculated based on the rates associated with the products in the documents. In the sales extract, the values presented are calculated based on the total values of the documents.

Example: